I recently had lunch with a newer investor that asked me about the numbers for my first deal. This got me thinking about how I analyzed deals when I first started in Real Estate investing vs today. I dug up the spreadsheet I used and realized that not much has changed. What worked then still works today. For me, it also highlights the fact that Real Estate investing is not that hard! If you put the time into understanding the structure of a Real Estate deal including market conditions, finance, value add, and geography; you can apply it to a single family rental or a 100 unit apartment complex. In this article I’m going to outline the method I used to find, underwrite, and finance that first deal. Coincidentally, I still use the same spreadsheet today to run high level numbers on any size deal.

How I Found the Deal

To be clear, when I started out, I didn’t look for a deal to buy until I put a great deal of time into educating myself on many facets of Real Estate and investing in general. That preparation made me much more comfortable when it came time to deploy my hard earned capital. Many of the books I read can be found here:

I knew I wanted to target value add deals that cash flowed. Appreciation was not on my radar. I considered it a bonus. What I wanted was cash flow to, eventually, replace my W2 income. This brought me to targeting lower income housing in decent areas that were guaranteed to cash flow after expenses were paid every month.

I looked everywhere. I talked to as many Real Estate agents, wholesalers, brokers, lenders, investors and let them know what I was looking for. The more people you tell what you want, the better chance you have of it showing up at your doorstep. I scoured Craiglist, the MLS, foreclosure lists, you name it. Related Aticle:

5 Ways to Find Off Market Deals

As I’ve mentioned before www.biggerpockets.com was a huge part of my early education. Coincidentally, it’s also where I found my first deal. I looked at the marketplace twice a day in hopes that something would fit my criteria. Eventually, I saw a deal in SW Atlanta in an up and coming neighborhood. It wasn’t the best area but was on a quiet street right across from a beautiful park. The deal was listed by a wholesaler. After some negotiation, we arrived at a price and I got it under contract, sight unseen, with a 7 day inspection period.

How I Analyzed the Deal

I got a reference on a property manager and contractor from a local investor friend that I trusted. I met both of them at the property to get an estimate of rent as well as rehab.

Purchase price: $39,500 cash

Rehab Estimate: $25,000

After Repair Value(ARV): $90,000

Monthly Rent: $950

The After Repair Value was a crucial piece of the deal. Since my strategy was to grow a portfolio as large as I could, I knew I couldn’t leave large amounts of capital in any of the deals, which brought me to the BRRR or value add investing strategy. Essentially, finding distressed properties that needed work, adding value by rehabbing the property, and ensuring that once brought back to retail standard, the property would appraise for > 25% of the acquisition + rehab cost. More on that strategy here:

How to Buy a Rental Property With No Money

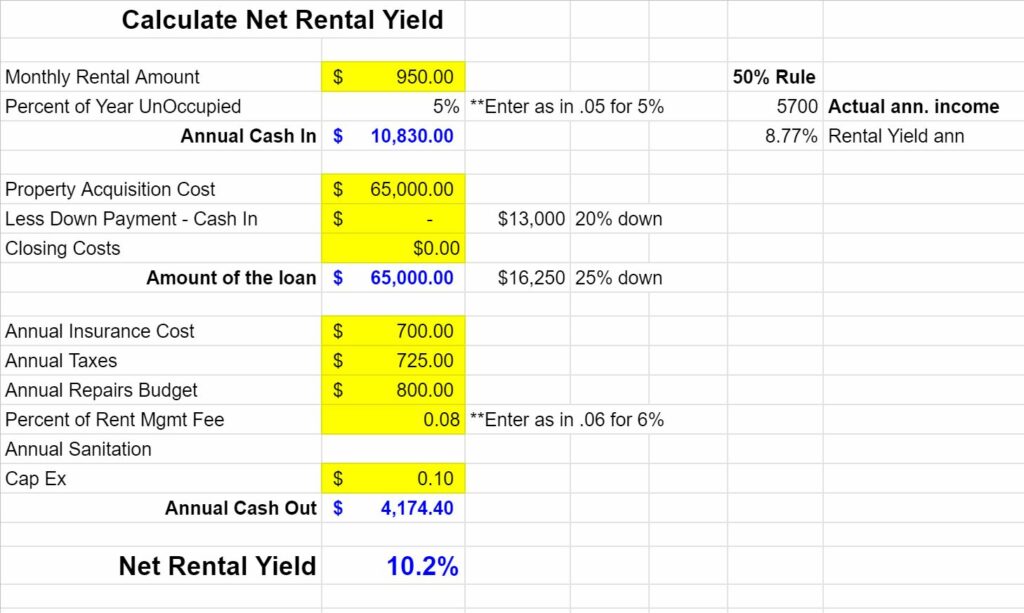

Once I had the data I needed, I plugged it into my Cash Flow Calculator. The same spreadsheet can be downloaded here by entering your info into the popup.

Net Rental Yield is the net cash return based on the acquisition cost minus expenses, without debt. Since I knew I was going to refinance the property to return capital, once it was rehabbed; I also ran the numbers once debt, or leverage, was put on the property. Shown here:

After the mortgage was paid and money was put aside for repairs and cap ex, there was, conservatively $100-$200 a month left over. This might not seem like a lot but the numbers naturally grow over time with rent increases AND I created 25k in equity. After getting a loan of 75% LTV from the bank, 100% of my capital was returned at closing.

The End Result:

After a few months I refinanced the property and received 100% of my capital back. It appraised very close to my estimate at $90,000. After the bank gave me a loan for 75% Loan to Value (LTV), I received $67,500 at closing, enough to cover my acquisition + rehab costs as well as closing costs.

I now own a house that I have $0 in, and cash flows a few hundred dollars a month. My net worth also instantly increased by $25,000 (the amount of equity). As you can see above, my Cash on Cash return (CoC) is infinite since there is no money left in the deal.

For reference here’s a snapshot of how the #’s have changed over time, after 4 years. The property is also worth ~155,000 at the time of this writing.

I’ve continued to use this same approach on dozens of deals to date and have saved a copy of the same underwriting spreadsheet for every deal.

See how I used a similar strategy to Scale My Rental Portfolio and ultimately achieve financial freedom.

Ready to Level Up Your Portfolio?

Get a jump start on generating your own passive income. Partner with me today to learn the ins and outs of my passive investing strategy and to discuss how I can help you increase your income and net worth.